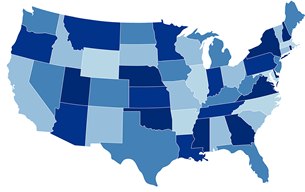

Where We Work...

Geography:

At Intrust, we believe that an organization is no better than the people who represent it. Our entire operation, including field appraisers, file reviewers, account managers, as well as our support staff, is comprised of high-grade professionals across the country.

We perform supervisory review of all files, and it makes the difference. This is demonstrated by our proven track-record of success with our clients. When you do business with us, you can be assured that nothing will be overlooked, and all relevant facts will be presented to achieve a fair settlement of the loss.